Which Countries Pay The Most In Gasoline Taxes?

In March 2021, the average price for a gallon of regular gas in the U.S. was $2.86. Fast forward to March 2022 and the national average has increased to $4.23.

A similar pattern has resonated with the price of crude oil in the past year. In March of 2021, the price of crude oil was $64 per barrel. One year later, the price has risen to $95.

Of course what you pay at the pump can vary depending on where in the world you are fueling up, because some countries will tax fuel more heavily than others. In some cases, half of the cost is just for the fuel itself. The UK, for example, taxes fuel twice as much.

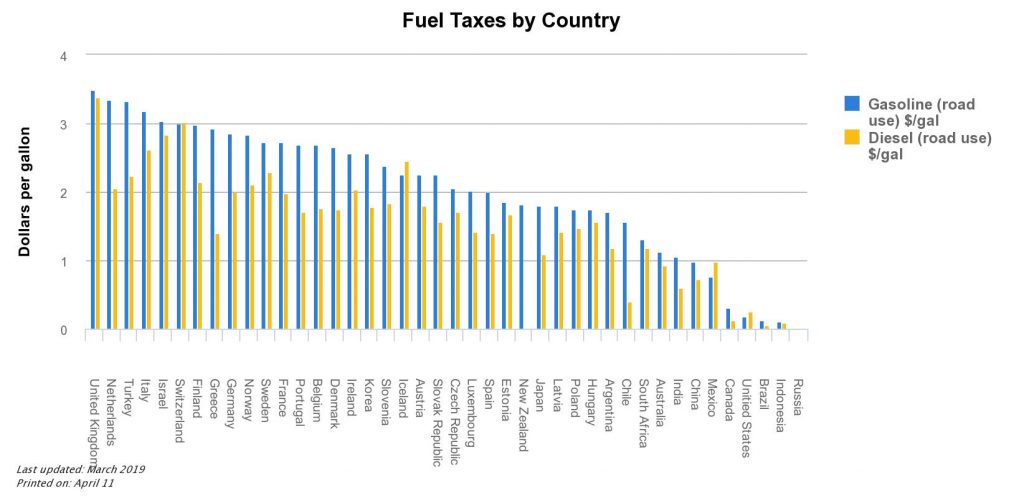

According to data from the U.S. Department of Energy’s Alternative Fuels Data Center, many European countries applied very high taxes per gallon when compared to non-European countries like the U.S., Indonesia, Russia, Brazil, Canada, Mexico, and China. Even though the chart below is based on information in 2018, the price per gallon has certainly increased, but the tax rates have likely remained the same.

One might also take note of how certain countries tax gasoline and diesel differently. While some nations like Indonesia, Switzerland, and the UK tax both fuels about the same, most countries will apply a tax for diesel at a much lower rate when compared to gasoline. In Chile, there is only a $0.39 tax on diesel, but $1.57 for gasoline. In Greece, gasoline is taxed at $2.93, while diesel is nearly half that at only $1.40.

Meanwhile, the inverse is in effect for the U.S., Mexico, and Iceland where diesel is taxed higher than standard gasoline. However, despite appearing on the list, Russia shows no figures on its taxes for fuel.

Take comfort knowing that if you ever feel upset at what you’re paying every time you fuel up, just be happy that you don’t live in the U.K.

Want to read more articles like this?

Join the PowerNation Email NewsletterRead More from PowerNation

- Chapters

- descriptions off, selected

- captions off, selected

This is a modal window.